The Missing Piece in the Renewable Debate

Europe’s energy transition is often framed as a binary choice between fossil fuels and variable renewables. Wind and solar dominate investment headlines — and rightly so. But as Europe moves toward deeper decarbonisation, a structural question emerges:

Who guarantees stability when the wind does not blow and the sun does not shine?

Biomass — particularly in combined heat and power (CHP) systems — plays a quiet but critical role. Unlike intermittent renewables, biomass is dispatchable, storable, and grid-supportive. In a system with rising electrification and declining fossil backup capacity, these characteristics are not secondary — they are strategic.

Energy Security After 2022: A New Policy Lens

The energy crisis triggered by Russia’s invasion of Ukraine reshaped Europe’s priorities. Energy security moved from background concern to central policy driver.

Under the REPowerEU Plan, the European Commission accelerated renewable deployment while simultaneously stressing domestic energy sources and diversification. Biomass, already accounting for roughly 60% of the EU’s renewable energy consumption (primarily in heat), became part of the resilience equation.

Source: European Commission – REPowerEU; Eurostat renewable energy statistics.

Unlike imported fossil fuels, sustainably managed biomass can be sourced within Europe or through diversified trade partners. It supports:

- District heating networks

- Industrial process heat

- Flexible electricity generation

- Rural economic development

In security terms, biomass is not just renewable — it is strategically controllable.

Dispatchability: The System Value of Biomass

As renewable penetration rises, system operators face three structural challenges:

- Seasonal variability

- Peak load events

- Industrial heat electrification limits

Wind and solar address annual energy volumes.

Biomass addresses system balance.

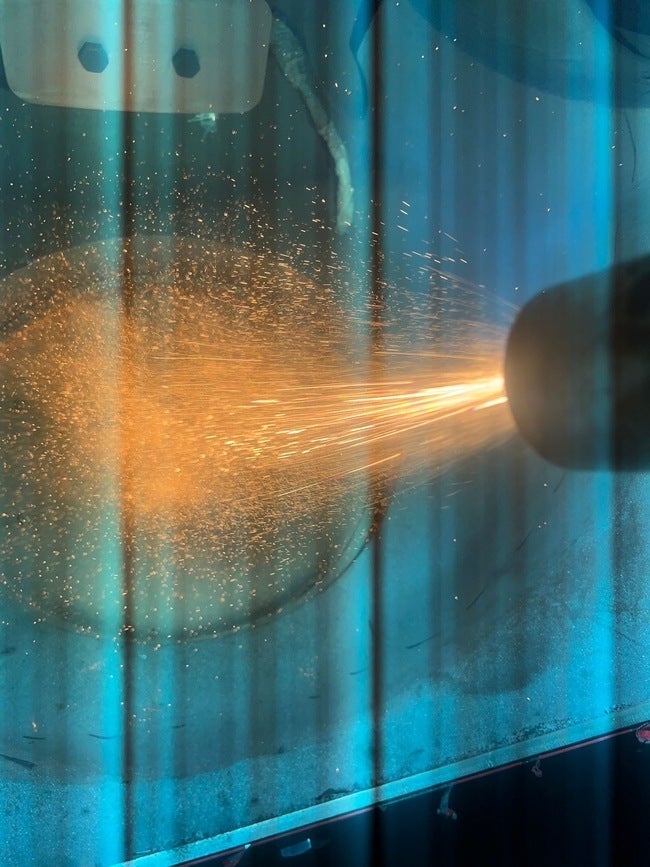

Combined Heat and Power plants can:

- Operate during peak demand

- Provide frequency support

- Supply stable thermal energy to cities

- Reduce dependency on natural gas in district heating

The International Energy Agency (IEA) repeatedly highlights the need for flexible low-carbon resources to complement variable renewables. Biomass is one of the few renewable technologies capable of fulfilling that role today.

Source: IEA – Net Zero by 2050 Roadmap; IEA Bioenergy Reports.

Heat: The Overlooked Frontier

Electricity often dominates decarbonisation discussions. Yet heating accounts for roughly half of final energy consumption in Europe.

Here, biomass already plays a substantial role. In countries such as Sweden, Finland, Austria and Denmark, bioenergy is deeply integrated into district heating systems.

Replacing fossil gas in heat networks is not hypothetical — it is operational reality in several Member States.

RED III reinforces this direction by prioritising efficient biomass use (e.g., CHP over electricity-only plants).

This shift aligns biomass with:

- Urban decarbonisation

- Energy efficiency targets

- Local resource cycles

Industrial Policy: Biomass Beyond Power

Biomass is not limited to combustion. It forms the foundation of the broader bioeconomy:

- Advanced biofuels for aviation and maritime sectors

- Biochemicals and bioplastics

- Renewable gases

- BECCS (Bioenergy with Carbon Capture and Storage)

Hard-to-electrify sectors — aviation, cement, steel, chemicals — require molecular solutions. Biomass provides carbon molecules without fossil extraction.

The European Commission’s climate scenarios (Fit for 55, Long-Term Strategy) include biomass and carbon removals as integral components of the net-zero pathway.

Source: European Commission – Fit for 55 package; EU Long-Term Strategy; IPCC AR6 mitigation pathways.

BECCS: From Renewable to Carbon-Negative

Perhaps the most transformative potential of biomass lies in negative emissions.

When biomass absorbs CO₂ during growth and emissions are captured during energy conversion, the result is net carbon removal.

The UK, Sweden, and the Netherlands are actively exploring BECCS deployment.

The IEA Net Zero scenario includes bioenergy with CCS as a contributor to global carbon removals by mid-century.

If Europe aims not only to reduce emissions but to compensate for residual sectors, BECCS becomes strategically important.

Biomass thus evolves from:

Renewable energy → System stabiliser → Carbon removal instrument

Challenges — and Why Governance Matters

Biomass is politically sensitive. Concerns around forest management, biodiversity, and international pellet trade remain central to public debate.

This is precisely why RED III’s stricter sustainability criteria matter.

By introducing:

- No-go areas

- Stronger GHG accounting

- Mandatory certification

- Efficiency prioritisation

the EU is strengthening the credibility of sustainable biomass.

The future of biomass will depend less on technology and more on governance quality.

The Strategic Outlook to 2050

Looking ahead, three scenarios are possible:

1. Marginalisation — Biomass retreats due to political pressure and restrictive sourcing.

2. Status quo — Biomass remains a secondary renewable heat source.

3. Strategic integration — Biomass becomes a certified, efficiency-focused, BECCS-enabled pillar of Europe’s net-zero system.

The third scenario aligns best with energy security, industrial decarbonisation and carbon neutrality goals.

In a deeply decarbonised system, flexibility, molecules, and removals matter as much as electrons.

Biomass provides all three.

Conclusion

Biomass is no longer just part of the renewable mix — it is part of Europe’s strategic energy architecture.

As electrification accelerates and fossil backup declines, dispatchable renewables gain importance.

If governed responsibly and used efficiently, biomass will not compete with wind and solar — it will complement them.

The question is no longer whether biomass has a role.

The question is how strategically Europe chooses to use it.

Sources

- European Commission – REPowerEU Plan

- European Commission – Fit for 55 Package

- Directive (EU) 2023/2413 (RED III)

- IEA – Net Zero by 2050 Roadmap

- IEA Bioenergy Reports

- Eurostat – Renewable Energy Statistics

- IPCC AR6 Working Group III